Important to know: Relocating your business to the Cayman Islands offers a strategic advantage for forward-thinking entrepreneurs and global companies. Setting up a genuine physical presence with Cayman Enterprise City’s (CEC) award-winning free zones is quick, efficient, and cost-effective. CEC offers a streamlined experience and turn-key solutions within a tax neutral environment.

Canadian companies can take advantage of a favorable Tax Information Exchange Agreement (TIEA) between Canada and the Cayman Islands, which came into effect on June 1, 2011. This agreement provides a framework under which Canadian corporations can establish subsidiaries in the Cayman Islands, allowing them, under certain conditions, to earn tax-exempt revenues and repatriate profits back to their parent company in Canada as tax-free exempt surplus dividends.

The TIEA primarily benefits active business income earned by the Cayman subsidiary. However, not all income types may qualify for this favorable tax treatment. Passive income, such as interest, royalties, or income from certain specific activities like the insurance of Canadian risks, may be subject to Canadian taxation.

While the TIEA opens significant tax planning opportunities for Canadian companies, it is essential to structure Cayman operations carefully to ensure compliance with Canadian tax laws and international regulations. We recommend seeking professional tax and legal advice to fully understand the implications and requirements of operating under the TIEA, as individual circumstances may vary. Our team can help you to connect with experienced advisors who will ensure your business is compliant and set up for success.

Globally Recognized and Well-Regulated Free Zone

Operate your business in a world-class Special Economic Zone (SEZ) that ensures transparency, compliance, and efficiency.

No Direct Taxes

Enjoy zero local corporate, income, capital gains, payroll, or sales tax, creating a highly cost-effective environment for global operations.

Quick and Hassle-Free Setup

Establish your business in as little as 4–6 weeks, with streamlined processes designed for efficiency.

Fast-Tracked Work Permits and Residency Visas

Gain access to 5-year renewable Zone Employment Certificates (work permits) and residency visas, issued within just 5 days.

Safe and Stable British Overseas Territory

Benefit from a politically stable jurisdiction with a strong legal framework based on English common law, ensuring the safety and security of your business operations.

Access to Exceptional Professional Services

Work with experienced service providers who can assist with legal, financial, and compliance requirements, making your transition seamless.

Strategic Location for Business Growth

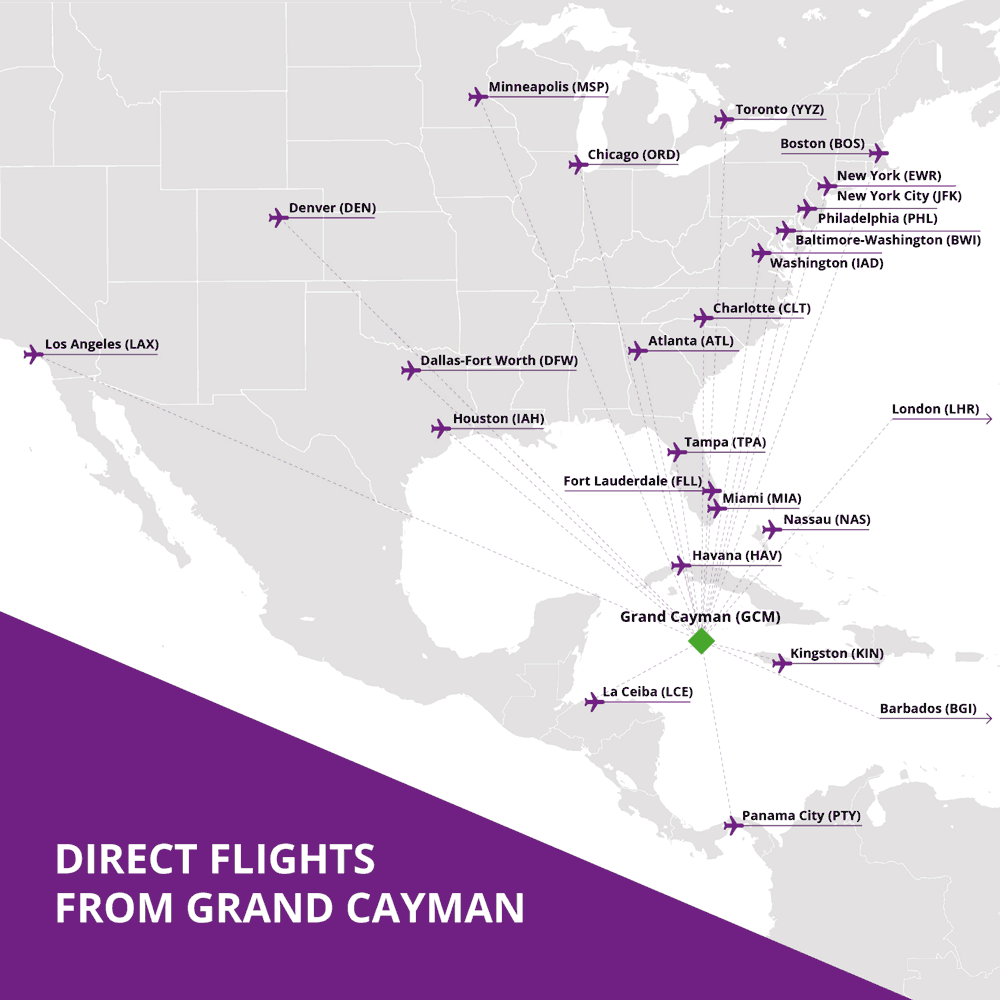

Easily access key markets in North America and Latin America, with excellent flight connections and a time zone conducive to global business operations.

Ongoing Support for Your Business

Receive dedicated support to help your business succeed, from workspace solutions to community networking opportunities.

Attractive Lifestyle for You and Your Team

Live and work in a tropical paradise with modern infrastructure, world-class healthcare, and excellent quality of life.

-2.png?width=2000&height=266&name=Untitled%20design%20(2)-2.png)

A location that offers a robust community and the opportunity for networking is crucial for business growth.

Businesses will have multiple chances to meet fellow innovators and enjoy a rich calendar of events including wellness programmes, industry focused seminars, educational workshops, thought- leadership conferences, as well as fun sporting and charitable events. Once you’re part of the CEC community, you’ll never feel like you’re venturing out on your own.

Offshore locations like the Cayman Islands offer a vibrant mix of local and expatriate populations, fostering a cosmopolitan environment.

Over 135 different nationalities are represented in Cayman with a population of 66,653 people.

No need to enter the grey winter months, it’s time to jet set to the Cayman Islands–why not take advantage of Cayman Enterprise City and spend a few months in paradise?

3.3% of the population living in Grand Cayman are Canadian’s

50% of companies set up in CEC are from North America

150 registered healthcare facilities and little to no wait time to see physicians. There are 4.5 doctors and 6.3 nurses for every 1,000 people.

Up to 40% reduction in setup and ongoing physical office operation costs with CEC. Annual savings can be anywhere from USD $40,000 for two person offices to upwards of USD $100,000 to USD $500,000 for larger teams.

The CEC team takes the lead on helping you through the license application and work visas, saving you significant time and money. Services typically save members in the range of US$15,000 to $20,000 in legal/service provider set-up fees.

.png)

Mike and his team explored various options, including the Bahamas and Singapore, but Cayman stood out for several reasons. Its proximity to North America, sharing the same time zone as Toronto and New York, made logistical sense.

"CEC streamlined the immigration and work permit processes, which, while still challenging, were made a lot more manageable with their assistance."

.png)

The privately held royalty and streaming business has experienced tremendous growth since establishing in the SEZ.

"Our company has based its people in Cayman to take advantage of the business benefits offered by CEC. We have used those benefits to secure a talented team, to obtain hassle-free work permits, and to streamline our business within a tax neutral environment."

After relocating to the Cayman Islands nearly nine years ago with her family, Tanya, Founder and Strategist at CRO:NYX Digital, has built a thriving business while embracing the island’s unique lifestyle and opportunities.

"CEC has been instrumental in our growth. The Tech Talks, for example, have been invaluable for learning about innovative ideas and connecting with like-minded professionals."

It's more than a great place to live. Learn about the benefits of moving offshore.

If you would like to hear more about Cayman’s thriving special economic zones and discover what our team can do to help your business grow please don’t hesitate to get in touch – trading in the snow for white sandy beaches is easier than you think.

We sat down with Santosh Prasad and Ernie Nagratha from international tax advise company Trowbridge who shared their extensive expertise and experience in helping individuals and corporations to set up and operate abroad.

© Cayman Enterprise City. All rights reserved. T: +1 (345) 945-3722 E: info@caymanenterprisecity.com